📘 What is Valuation in Civil Engineering?

In Civil Engineering, valuation refers to the systematic estimation of the present monetary worth of a tangible asset—such as land, buildings, or infrastructure—at a specific point in time. This process involves a careful analysis of various factors like location, construction quality, age of the structure, market trends, and income-generating potential. Valuation is essential not only for property transactions but also for strategic planning, budgeting, taxation, insurance, and legal settlements.

It plays a pivotal role in construction planning and management, enabling engineers, government agencies, financial institutions, and private clients to make informed decisions regarding property development, investment analysis, rent assessment, taxation liabilities, and fair compensation in acquisition or damage cases. Accurate valuation also helps in lifecycle cost estimation, return on investment (ROI) calculations, and overall financial management of civil engineering projects.

🧠 JKSSB Insight: Questions are often asked about methods of valuation, capitalized value, depreciation, and terms like salvage value, scrap value, etc.

🌟 Objectives of Valuation in Construction Projects

| Objective | Description |

|---|---|

| Buying/Selling Property | Helps buyers/sellers know the fair market value. A correct valuation ensures that the property is not under or overpriced, which prevents disputes and encourages smooth transactions. |

| Taxation Purposes | Local authorities charge property tax based on assessed value. Valuation helps determine the annual property tax liabilities imposed by municipal or state governments. |

| Insurance | To determine the insurable value of buildings. Insurers require the reinstatement value to estimate premiums and payout in case of damage. |

| Mortgage/Loan | Banks require accurate valuation before approving loans. It helps lenders assess the property as collateral and minimize the risk of default. |

| Rental Fixation | Helps landlords fix a fair monthly rent. The rental value is often derived from the capital value using the expected rate of return or yield. |

| Asset Management | Companies and governments need valuation for accounting and asset control. Book valuation is necessary for depreciation accounting, investment tracking, and audit purposes. |

| Compensation | Fair compensation during land acquisition or damage. Government acquisitions under the Land Acquisition Act or disaster relief disbursements depend on thorough property valuation. |

🔍 Factors Affecting Valuation

| Factor | Influence |

|---|---|

| Location | Prime areas have higher valuation. |

| Accessibility | Near roads, transport, markets = higher value. |

| Type of Structure | RCC structures have better durability and hence more value. |

| Age of Building | Older buildings depreciate, reducing value. |

| Purpose | Commercial properties are generally valued higher than residential ones. |

| Legal Status | Clear titles and approvals raise valuation. |

📂 Types of Valuation in Construction

1. 🏠 Freehold Property Valuation

- Owner has complete and unrestricted legal rights over the land and any structures built upon it, including the right to sell, lease, or develop the property.

- Valuation is primarily based on the market value, considering key factors such as location, land area, built-up area, type and quality of construction, age of the structure, current demand-supply trends in the area, and potential for future development. Freehold properties typically command higher values due to their permanent ownership nature and absence of leasehold limitations.

2. 🏢 Leasehold Property Valuation

- Property leased for a fixed period (e.g., 30 years, 99 years).

- In a leasehold property, the lessee (tenant) has rights over the property for a specified duration, while the ownership remains with the lessor.

- Value depends on remaining lease period, annual rent receivable, and terms of the lease agreement such as renewal clauses or escalation of rent.

- As the lease term nears expiry, the property value typically decreases unless there is provision for renewal or extension.

- Leasehold valuations may also factor in the cost of obtaining freehold rights or conversion charges, if applicable under local regulations.

3. 💰 Rental Valuation

- Used to calculate standard rent based on the capital cost of the building, rate of return, and permissible outgoings such as taxes and repairs.

- Important for government buildings, court cases related to rent control, and tenancy disputes, where legally fixed rent needs to be assessed fairly.

- Also used in determining whether existing rent is excessive or reasonable as per local rent control acts.

- Standard rent prevents exploitation of tenants and ensures a steady return to landlords in regulated rental markets.

4. 🏜️ Scrap Value Valuation

- For dilapidated or obsolete buildings.

- Value is estimated from the salvageable material such as bricks, steel, wood, and fittings that can be resold or reused.

- This type of valuation is typically performed when a building is no longer fit for occupancy and demolition is planned.

- The scrap value provides a base figure for negotiating demolition contracts or when calculating depreciation limits.

- It is especially relevant in industrial structures, old warehouses, or unsafe residential buildings scheduled for redevelopment.

5. ♻️ Salvage Value

- The resale value of materials like bricks, steel, timber, doors, windows, sanitary fittings, electrical wires, and roofing sheets after the building is demolished. These materials are assessed for their condition, usability, and current market demand. Salvage value plays an important role in final valuation as it can significantly offset demolition costs or be used as credit in cost-benefit analysis of redevelopment projects.

6. 📒 Book Valuation

- Used in company balance sheets to reflect the current accounting value of a fixed asset.

- Value is reduced annually by depreciation, which accounts for wear and tear, aging, and obsolescence.

- Book valuation helps track the asset’s worth over its useful life and is important for financial reporting, audits, and calculating capital gains or losses during sale or disposal.

- Different depreciation methods like Straight Line or Reducing Balance may be applied depending on the accounting policy adopted by the organization.

🧳️ Detailed Methods of Valuation

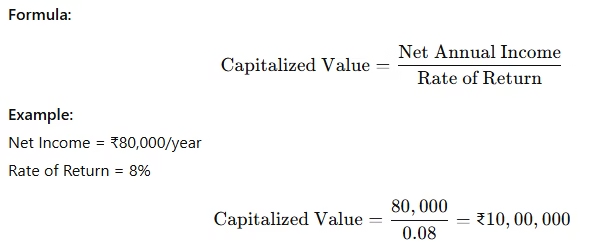

1. 📊 Rental or Income Method

This method is widely used for income-generating properties such as commercial buildings, shopping complexes, office spaces, and rental apartments. It is based on the principle that the value of a property is directly related to the income it can generate.

The formula helps to determine the capitalized value or present worth of expected net income from the property. The net annual income is calculated after deducting all outgoings like property tax, maintenance charges, insurance, and other operational costs.

This means the value of the property, based on the income it generates annually and assuming an 8% return expectation, would be ₹10 lakh. This method is especially useful for comparing investment potential across different properties.

2. 🏗️ Cost Method

Steps:

- Estimate the cost of new construction based on current market rates for materials, labor, equipment, contractor’s profit, and overheads. This is also known as the replacement or reproduction cost.

- Deduct depreciation considering factors such as physical deterioration, functional obsolescence, and economic obsolescence.

- Add land value, which is calculated separately based on market conditions and its potential use.

This method is especially useful for valuing new buildings, special-purpose properties, and public utility structures where income generation is not a primary concern. It provides a realistic estimate of what it would cost to recreate the asset in its current condition.

Valuation = Present Cost − Depreciation + Land Value

3. ♻️ Comparison Method

- Compare with recently sold similar properties in the area by analyzing sale deeds, transaction history, and property listings.

- Adjust for differences like location (corner plot vs interior), area (built-up or carpet), structure type (RCC vs load-bearing), age, and amenities (lift, parking, garden, etc).

- This method reflects the market-driven approach and is most accurate when multiple recent sales are available for truly comparable properties.

- Often used in residential and urban real estate markets where properties have similar use, condition, and zoning.

4. 💼 Profit Method

This method is applied to commercial properties that do not generate rental income directly but earn profits through operations, such as hotels, cinemas, malls, and amusement parks.

The value is based on the net annual profit the business generates from the property after deducting all expenses like staff salaries, maintenance, utilities, and taxes.

It is suitable for specialized properties where the value is tied to the business income rather than the physical attributes or market comparables.

The estimated net profit is capitalized using an expected rate of return to determine the property’s value. Proper accounting and business records are essential for accurate valuation under this method.

Formula: \text{Capitalized Value} = \frac{\text{Net Annual Profit}}{\text{Expected Return Rate}}\

5. 🏞️ Development Method

This method is used to estimate the value of undeveloped or raw land that is intended for development into plots for residential, commercial, or industrial purposes.

Steps involved:

- Estimate the sale price of the developed plots based on prevailing market rates in that locality.

- Deduct the cost of development, which includes expenses like road construction, drainage, water supply, electricity, landscaping, legal approvals, and amenities.

- Deduct a reasonable developer’s profit margin or return on investment.

- The remaining amount gives the current value of the raw land.

This method is useful for valuing large land parcels in city outskirts or new townships and helps determine feasibility for investors and town planners.

🧾 Depreciation in Valuation

| Method | How it Works | Example |

|---|---|---|

| Straight Line Method | Equal depreciation yearly | Cost = ₹10,00,000, Life = 20 yrs ➔ Dep = ₹50,000/yr |

| Constant Percentage | % of previous year’s value | Reduces faster initially |

| Sinking Fund Method | Yearly deposit earns interest for replacement | Useful for public assets |

📃 Real-Life Example: Govt. Building

- Govt. building has no rent.

- Age = 10 yrs, Depreciation = 2% per year

- Land Value = ₹5,00,000, Construction Cost = ₹20,00,000

Depreciation = 20,00,000 × 2% × 10 = ₹4,00,000

Valuation = 20,00,000 – 4,00,000 + 5,00,000 = ₹21,00,000

📘 Key Valuation Terms

| Term | Definition |

|---|---|

| Capitalized Value | Present worth of future net returns. |

| Scrap Value | Value of dismantled materials. |

| Salvage Value | Estimated resale value at end of life. |

| Obsolescence | Loss due to outdated design/technology. |

| Depreciation | Loss in value over time due to wear/use. |

| Sinking Fund | Reserve for rebuilding after useful life. |

📚 Important JKSSB MCQ Areas

- Formula for Capitalized Value

- Methods of Depreciation

- Difference between Scrap and Salvage Value

- Best valuation method for commercial buildings

- Factors influencing property value

✅ Conclusion

Valuation is a foundational concept in civil engineering, essential for ensuring cost-efficiency and informed decision-making throughout a project’s lifecycle. It encompasses a wide range of disciplines including economics, structural analysis, depreciation accounting, legal aspects, and investment planning. For aspirants preparing for JKSSB and other competitive exams, a deep understanding of valuation techniques, formulas, practical examples, and real-life applications is key to solving high-scoring questions and improving exam performance.